There is strong potential for bad faith litigation against insurance providers following the Texas ice storm, involving claims that those carriers have not upheld their end of the contract.

Roadside view of Highlands at Westridge Community covered by heavy snow on February in Texas after winter storm.

Property damage claims from the devastating winter storm that rampaged across Texas last month and left millions without power as temperatures plummeted to single digits are pouring in and could surpass any amount generated by an event, according to a recent story by Jason Grant.

“Texans are calling their homeowner’s insurance in droves and opening up claims based on the property damage that resulted from the weather and power outages,” says John Kelly, a practicing attorney and insurance law expert at Kelly Law Team in Phoenix, Arizona.

“Many are dealing with unexpected and extensive damage, including water damage from frozen piping,” he said.

Many insurance companies have denied coverage on the damage, leaving homeowners with service bills and repairs that often cost thousands of dollars, Kelly explained.

A wave of lawsuits are coming

“Attorneys will be reviewing the policies to determine if they can force the insurance companies to cover the damage,” he said. “An insurance policy, which is a contract, will often have extensive exclusions to coverage that consumers are often surprised by and understandably upset [about],“ he continued.

In fact, there will be a growing number of lawsuits filed by individuals and groups in the coming days and weeks, Kelly predicted.

“It will take months and likely years before the merits of cases will be heard and ruled upon by judges and juries, however resolutions short of trial can come for individuals who have valid claims within weeks,” Kelly said.

According to Kelly, attorneys need to focus on the potential for bad faith litigation against insurance providers, involving claims that those carriers have not upheld their end of the contract.

“The relationship between an insurance company and the insured person is a first-party relationship, which obligates the insurer to a higher standard of care to adhere to the terms of the contract,” Kelly said.

“This means that the contractual language, where vague, should be construed in favor of the consumer,” he explained.

As a result, homeowners need to be aware of the contract they have with the insurance company, he continued. This means that it is a good idea to get a full copy of the insurance policy they have signed and read over any exclusions.

“If their claim is denied, the adjuster should be able to point them to the particular exclusion or language they are basing the denial upon,” Kelly said. “It is important to read and understand the exact language that is being used to deny the coverage. This will help attorneys evaluate whether it is possible to pursue a remedy.”

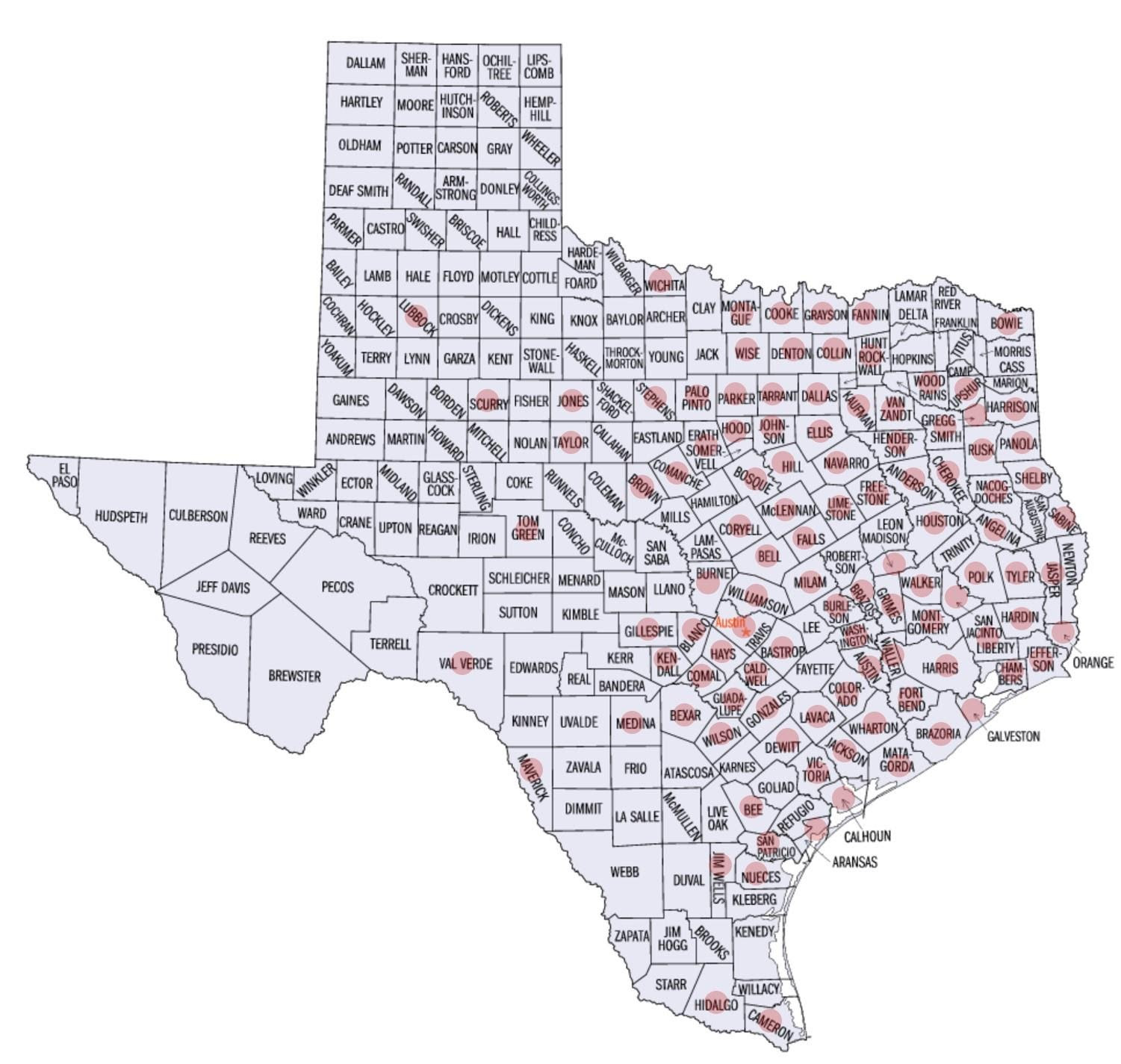

Texas counties qualifying for FEMA assistance

A total of 108 Texas counties (highlighted with a red circle) have qualified for disaster assistance through FEMA due to the severe winter storms, writes ALM Intelligence analyst Mark Moore.

According to the FEMA site, “disaster assistance may include financial assistance for temporary lodging and home repairs, low-interest loans to cover uninsured property losses, and other programs to help individuals and business owners recover from the effects of the disaster.”

Requests for federal assistance (see here) are to supplement insurance claims, which requestors must file with their carriers as soon as possible.