A 40 knot (about 46 MPH) dust storm was a contributing factor in the incident involving the Ever Given, which is operated by Evergreen Marine. With containers stacked seven high or more on a deck, the cargo can serve as a giant, unwanted sail on such blustery days.

Transoceanic sailing has always been a risky proposition. But is a spate of headline-grabbing incidents flashing signs of growing exposure for seafaring cargo?

The most recent event, and perhaps the most dramatic, involved the mega-sized container ship Ever Given, which was pushed almost perpendicularly across the Suez Canal. This blocked the route for around 30% of all daily shipping container traffic worldwide, according to Patrick Hickey, senior underwriting director for Intact Ocean Marine.

The ship was freed after six days, however it left a backlog and major accumulation of cargo risk throughout the supply chain, Hickey says.

“The demand for cargo and space on ships reached historic levels in 2020 and some companies have reported that they moved more freight in Q4 2020 than any quarter in history,” he adds. “The vessels, ports, trucking companies and rail yards are all operating at near maximum capacity and moving a majority of the freight safely.”

Total losses from the Ever Given accident are still unknown. Here’s what is known: The incident showcased one of the myriad associated with risks with mega-ships, which can be as long as a skyscraper and carry as many as 24,000 containers.Previous

While supersized vessels bring with them economy-of-scale benefits, they also have the downside of concentrating risk, according to Capt. Andrew Kinsey, senior marine risk consultant for Allianz Global Corporate & Specialty (AGCS).

“Whether it is mis-declaring cargo, fire or an issue with properly securing, we have to look at it holistically and consider the overall accumulation of risk with the size of these vessels,” Kinsey says. “It is incumbent on all stakeholders to address these issues. It is not just on the loading and securing workers. It is going to take people at the terminals and cargo owners themselves making sure the containers are properly stowed, weighed and declared.”

Behemoth accommodations

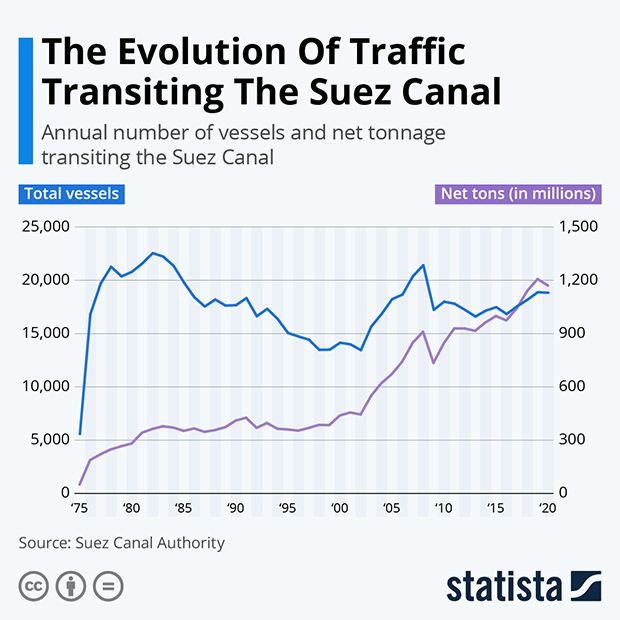

As seen in Egypt’s bustling waterway, which hosted more than 18,500 vessels in 2020 alone, one question is whether such mega-ships are even salvageable.

The answer at the time of a crisis seems to be yes, but freeing the Ever Given was far from simple. Consider that in recent years, engineers have been dredging channels, expanding ports and raising bridges to accommodate gargantuan ships, according to Sean Dalton, head of marine, North America, for Munich Reinsurance America.

Yet, if there is a loss of steerage — due to power outage, high winds or unforeseeable factors — costly shipments can go sideways despite best-made efforts to save them.

In Ever Given’s case, a 40 knot (about 46 MPH) dust storm was a contributing factor. With containers stacked seven high or more on a deck, the cargo can serve as a giant, unwanted sail on such blustery days.

“Either the boat will list or be blown away because of the ‘big sail,’” explains Jose Guerrero, president of Virtual Claims Services. “What I learned first during my sailing days is ships do not have brakes. It requires a lot of distance to stop. If we are looking at the width of the Suez Canal, that’s not enough distance.”

Outside of the event on the Suez, there also has been an uptick in containers lost overboard, which is likely due to a combination of many factors such as vessel capacity and container loads.

Piling further stress onto the situation was extra heavy weather in the Pacific in 2020, according to AGCS’ Ryan O’ Connor, North American head of ocean cargo.

Environmental elements such as “green water,” or large quantities of water on deck left by massive waves caused by severe storms and heavy winds, and parametric rolling are combining to exceed the ability of cargo security systems, O’ Connor says.

A byproduct of mega-ships’ streamlined designs (large bow flares and wide beams) is the increased chance of severe parametric rolling (side-to-side, or port-starboard, tiling).

Design features that aim to decrease friction as bows pass through water can also cause flare immersion in waves as they crest along a hull. This brings the bow down and causes stability to vary, which leads to rolling, according to Marine Insights. The process repeats itself through the next wave cycle, resulting in a synchronous motion that can intensify the angle of the roll as much as 30 degrees in a few wave cycles. As the angle becomes more severe, so does the tension on lashings.

Danger on the high seas

Also at hand are rising numbers of cargo fires and mis-declared loads.

In its 2020 Safety and Shipping Review, AGCS reported 40 cargo-related fires in 2019 — roughly one every 10 days. Compounding the issue is the fact that smaller fires and near misses are unreported, making the likely rate of fire incidents much higher than those reported.

While ships have grown vastly larger since the 1970s, their crews have been reduced by about a quarter, and the average number of onboard firefighting has hoses only increased from one to two, AGCS reports.

Improperly declared and stowed containers can lead to catastrophic losses. This played out in Beirut during the summer of 2020 when 2,750 metric tons of ammonium nitrate, which was stored for six years in the city’s port without proper safety measures, detonated. The tragedy left around 200 dead, 7,500 injured and an estimated $15 billion in property damage.

The National Cargo Bureau (NCB) studied the issue and found the majority of containers it inspected had mis-declared or improperly stowed cargo.

Of the 500 containers NCB studied, more than half failed with one or more deficiencies, with nearly 70% of import containers holding dangerous goods not passing. Export containers with dangerous goods saw a 38% failure rate. Deficiencies found included problems with the way cargo was secured, labeled and declared.

“The NCB analysis of cargo inspections makes for somber reading, to say the least. In fact, the findings are frankly shocking. We know cargo mis-declaration is a problem; now we have empirical data that shows the true extent of the situation,” Kinsey notes in AGCS’s report.

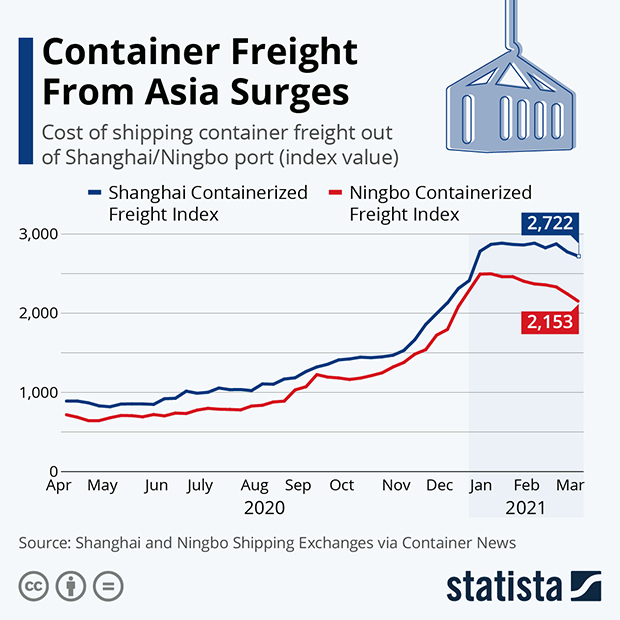

Also grabbing headlines in recent months has been eye-popping shipping cost growth, with rates out of some Asian ports swelling as much as 300%.

While freight costs do factor into the overall cost insureds must consider when looking at policies, O’ Connor says they don’t figure all that prominently when it comes to cargo insurance rates.

Market hardening

The seas have been choppy for the marine cargo market recently but the sector actually began to see conditions hardening a few years ago, according to O’Connor.

“From our data, you are looking at consistent rate increases since about mid-2019,” says Michael Pellegrini, Marsh McLennan’s marine practice leader for the U.S. and Canada. “For our transit-focused clients, doing cargo only, rates were consistently growing at 20%. For those programs that have catastrophic coverage exposure, it was more in the 25%-30% range.”

He adds, however, that as 2021 has progressed, there has been a deceleration in rate growth.

“Rates are going from 20% or higher to a more measured approach with increases,” says Pellegrini. Rate growth is now closer to the 15% range.

“Since the hardening of the market, we have seen a large increase in the number of accounts that are written on a quota share/subscription basis,” O’Connor says, adding that this helps reduce volatility with regard to a large loss. However, a large portion of the U.S. cargo business is written on a 100% insurer basis.

“Large corporate clients today are more likely to consider retention options through captive insurers as well as considering alternative risk transfer options,” he says.

Although the past few years have brought hard market conditions, they follow decades of soft rates for ocean marine, according to Samuel Chung, vice president of cargo underwriting for Amwins Specialty Logistics Underwriters.

Recent rate growth was driven “a bit by a question about rate adequacy,” he says. The potential for loss always existed, he adds, but the market hadn’t allowed for proper loss funding.

“Folks couldn’t help themselves; it was a race to the bottom,” he says. “When the inevitable catastrophe or general event happens, you are caught asking yourself, ‘Where did we go wrong?’ If you are writing accounts that are underfunded all the way, it is hard to correct quickly. Last year was a knee-jerk reaction for sure.”

Pellegrini notes that long-term, the market will position itself to be competitive again.

“We are seeing signs of it now,” Pellegrini says. “Competition is coming back and appetites are better defined. That should give our clients more certainty around what they are going to get and make a better market for all parties.”