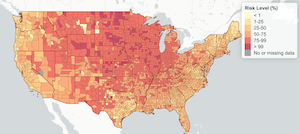

An interactive map developed by academics shows the risk level of attending a Thanksgiving event based on its size and location.

For a party size of 50 people, at the highest end of the scale, the most at-risk locations have a 99% chance of COVID infection.

As Americans prepare to celebrate Thanksgiving 2020, COVID-19 cases are surging across the country. More than 1 million COVID-19 cases have been reported in the U.S. in the last week, according to the CDC, and the infection rate continues to increase daily.

This surge comes just days before millions of Americans are expected to travel for Thanksgiving, according to AAA, worrying health experts and state officials, who are issuing warnings to the public and installing state-wide mandates to slow the spread.

Researchers from the Georgia Institute of Technology (Georgia Tech), the Applied Bioinformatics Laboratory and Stanford University recently developed an interactive map tool that measures the risk level of attending a Thanksgiving event based on its size and location. The COVID-19 Event Risk Assessment Planning Tool breaks down U.S. risk by county and also includes international data.

Spearheaded by Georgia Tech Professors Joshua Weitz and Clio Andris, the map tool was designed to help policymakers, event planners and individuals measure COVID risk exposure during the upcoming holiday. It has since been used by the Georgia Municipal Association, which represents all the mayors in that state, as well as organizations such as the Special Olympics to assess the risk of holding events, according to the L.A. Times.

Based on the map, for a party size of 50 people, at the highest end of the scale, the most at-risk locations pose a 99% chance of COVID infection. These counties are located primarily in North Dakota, South Dakota, Wyoming, Nebraska, Minnesota, Iowa, Kansas, Illinois, Wisconsin and Alaska.

The COVID risk tool measures risk levels as the estimated chance (0-100%) that at least one COVID-19 positive individual will be present at an event in a county, given the size of the event. Researchers explain that based on seroprevalence data and increases in testing, by default, the test assumes there are five times more cases than are being reported (5:1 ascertainment bias). In places with less testing availability, that bias may be higher.

The CDC is advising the safest way to celebrate Thanksgiving this year is to stay home with the people you live with.

COVID risks can, of course, be reduced by wearing a mask, distancing, and gathering outdoors in smaller groups.

Before committing to holiday travel or party plans this year, measure the risk at-hand, and consider any precautions that may be valuable in protecting yourself and loved ones, and also secure money spent on travel plans with the right travel insurance.