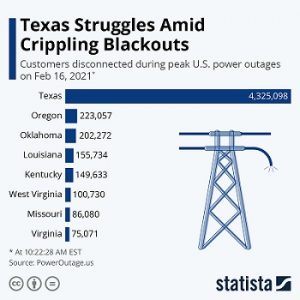

A decade ago, regulators said the power plants couldn’t withstand bitterly cold weather. Now, 4 million people are in the dark.

Transmission towers and power lines lead to a substation after a snowstorm on February 16, 2021, in Fort Worth, Texas.

(Bloomberg) — Federal regulators warned Texas that its power plants couldn’t be counted on to reliably churn out electricity in bitterly cold conditions a decade ago when the last deep freeze plunged 4 million people into the dark.

They recommended that utilities use more insulation, heat pipes and take other steps to winterize plants — strategies commonly observed in cooler climates but not in normally balmy Texas.

“Where did those recommendations go, and how were they implemented?” said Jeff Dennis, managing director of Advanced Energy Economy, an association of clean energy businesses. “Those are going to be some pretty key questions.”

As investigators probe the current power crisis in Texas, which has left millions of people without power or a promise of when it will be restored, questions are sure to be raised about how the state responded to the urgings from the 2011 analysis, issued by the Federal Energy Regulatory Commission and the North America Electric Reliability Corporation, which sets reliability standards.

The February 2011 incident occurred when an Arctic cold front descended on the Southwest, sending temperatures below freezing for four days in a row. The result was disastrous. Equipment and instruments froze, forcing the shutdown of power plants and rolling blackouts, according to the report.

The failures have already spurred a tangle of finger-pointing, with Texas Governor Greg Abbott calling on leaders of the Electric Reliability Council of Texas, the state’s grid operator, to resign.

“Many generators failed to adequately apply and institutionalize knowledge and recommendations from previous severe winter weather events, especially as to winterization of generation and plant auxiliary equipment,” the 2011 report said.

Although Ercot has called for companies to winterize their facilities, it can’t force them to do so.

Representatives of Ercot did not respond to emailed questions asking specifically about why key recommendations from 2011 went unheeded. But asked about the need for more weatherization in news conferences on Feb. 16 and 17, Ercot officials said that while it has called for companies to harden their facilities, it can’t force them to do so.

Power generators have voluntary guidelines to follow and already have a financial incentive to keep plants running during cold snaps when prices spike, Dan Woodfin, Ercot senior director of system operations, told reporters Tuesday, Feb. 16.

“There aren’t regulatory penalties at the current time” for not complying with the weatherization guidelines, Woodfin said.

A state law enacted after the 2011 freeze authorized the Public Utility Commission of Texas to require power companies to disclose their weatherization efforts. But the state has not gone further in mandating the precautions.

Some steps were taken to harden assets after 2011, and more will probably be spurred by this storm, said Alan Scheller-Wolf, a professor of operations management at Carnegie Mellon University’s Tepper School of Business. But economic factors — including how much consumers will tolerate in the form of higher electricity prices — will play a role in those decisions.

Separate grid

“Are you going to winterize if you don’t get your money back?” Scheller-Wolf questioned. “The Texas industry values less regulatory mandates and they value having their separate detached power grid, so I would find it unlikely that they are going to hit their companies with a raft of regulation.”

Power companies have little incentive to make investments in winterization they may not recoup, said Adrian Shelley, Texas office director of the advocacy group Public Citizen.

In the 1989 storm, wind chills reached 14 degrees below zero in Texas, forcing power plants to operate below capacity or fail to start altogether. And after that storm, as with the 2011 episode, regulators issued a slate of recommendations aimed at improving winterization.

“These recommendations were not mandatory, and over the course of time implementation lapsed,” FERC and NERC said in their 357-page report in 2011. “Many of the generators that experienced outages in 1989 failed again in 2011.”

The report recommended dozens of changes for lawmakers, regulators and power plants in the southern U.S. Among them: wider adoption of reliability standards to harden power plants and related equipment against the cold. Wind barriers, better insulation and heating systems could be installed, for example.

Similar steps are already taken to protect power plants and wind farms in reliably colder climates, from Norway to Canada.

Arctic blast

Southwestern power regulators should “prepare for the winter season with the same sense of urgency and priority as they prepare for the summer peak season,” NERC and FERC warned.

The failures this week underscore how much work still needs to be done.

Wind farms were paralyzed as rain and plummeting temperatures locked up turbines. Frozen instruments triggered shutdowns at some natural gas and coal plants. Natural gas flows were pinched as wells froze shut and supplies were diverted to home heating instead of power plants. Icy water even briefly took a nuclear plant in south Texas offline.

The unusual nature of this storm — with cold temperatures and winds buffeting plants — is also a factor, Ercot’s Woodfin said. “It’s been more severe than anything that’s happened before,” Woodfin said in a call Wednesday.

He cited freezing moisture in instrumentation lines as well as problems with trucked-in deliveries of water to one plant Wednesday morning.

There are myriad reasons Texas has seen outages, but many of the failures are likely tied to simply being unprepared for extreme cold weather — the same kind of problems highlighted in 2011, said Joshua Rhodes, a research associate at the University of Texas at Austin’s Webber Energy Group.

The current Arctic blast — which caused temperatures to fall two degrees below zero in Dallas on Tuesday — is far worse than 2011. For Texas grid operators and power generators, the question going forward will be whether they take steps to deal with the next bad winter storm.

“It’s never happened before,” Rhodes said. “But now it has happened, so we’re going to have to figure out do we plan for this? If so it will probably be more expensive.”