While less populated, states with fewer housing units face more prolonged wildfire recovery risks, according to CoreLogic.

Tom Larsen, principal, insurance solutions at CoreLogic, said in a release: “It’s important to acknowledge that not all communities and their catastrophic events are the same, and the road to recovery can look drastically different. Resilience is often measured as how fast you can recover from a catastrophe — and the deeper the wound, the longer it takes to heal.”

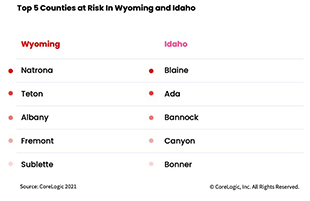

California typically tops rankings of states facing the most significant wildfire risks because of the sheer volume of its population; however, Wyoming and Idaho actually face the most risk for prolonged wildfire recoveries, according to a review by CoreLogic.

In addition to population, the data and analytics provider factored in other wildfire property risks communities face, including reconstruction material availability, temporary housing capacity, and the potential for economic recovery.

“There’s no denying a state like California is at severe risk for wildfire destruction every year, as seen in the ongoing Dixie Fire,” Tom Larsen, principal, insurance solutions at CoreLogic, said in a release. “It’s important to acknowledge that not all communities and their catastrophic events are the same, and the road to recovery can look drastically different. Resilience is often measured as how fast you can recover from a catastrophe — and the deeper the wound, the longer it takes to heal.”

Higher percentage of housing stock at risk

Consider, for example, the volume of housing available in California and Wyoming. If a wildfire destroys 800 homes in California, the recovery and lasting impact would not be similar to an event that saw 800 homes destroyed in Wyoming since the number of lost homes would be a greater percentage of the state’s available housing.

When analyzing wildfires through this lens, Wyoming, Idaho, New Mexico, Utah and Nevada face the most risk for prolonged recoveries, CoreLogic found.

Further, if a larger portion of a location’s population is displaced from the same event, the recovery time can be extended. Driving this is the potential for a shortage of local workers, who would be busy rebuilding their lives. Additionally, temporary housing, soaked up by displaced locals, would be in short supply for outside workers, CoreLogic reported.